What You Need To Know About probate letter of administration and succession certificate.

PROBATE LETTER OF ADMINISTRATION AND SUCCESSION CERTIFICATE.

When someone dies without a will, their estate is administered by the court. This process is called the “letter of administration.” The court appoints someone to act as administrator and oversee the estate until it can be settled.

The administrator has a number of responsibilities, including:

- Collecting estate taxes and managing bank accounts

- Negotiating and signing contracts

- Appointing fiduciaries to manage the estate’s assets

The administrator also has the power to appoint a successor if they die or are unable to perform their duties. This is called a “letter of administration and succession certificate.”

- Administering the deceased person’s property, including selling it and distributing the proceeds

- Serving legal papers, such as court orders and subpoenas

- Representing the estate in legal disputes

A letter of administration is a legal document that outlines these duties and other important information about the estate. It’s important to get this document if you are interested in becoming an administrator or if you are concerned about someone else’s role in the administration. You can get a copy from the court or from the administrator’s website.

A letter of administration is a document that is given to an individual when they die or become incapacitated. This document allows someone to take care of the individual’s business affairs.

WHAT IS A LETTER OF ADMINISTRATION?

A letter of administration is a legal document that outlines the duties of an administrator. The administrator is appointed by the court and has a number of responsibilities, such as:

- Collecting estate taxes and managing bank accounts

- Administering the deceased person’s property, including selling it and distributing the proceeds

- Serving legal papers, such as court orders and subpoenas

- Representing the estate in legal disputes

WHO GIVES YOU A LETTER OF ADMINISTRATION?

The person who is named in the letter of administration is the person who will be responsible for taking care of the individual’s business affairs. This can include everything from filing taxes to issuing checks.

WHAT ARE THE NECESSITIES FOR HAVING A LETTER OF ADMINISTRATION?

In order to get a letter of administration, you will need to meet certain requirements. These requirements will vary depending on the state, but typically you will need to provide proof of death or incapacity, as well as proof that you are the legal representative of the individual.

WHAT HAPPENS ONCE YOU HAVE A LETTER OF ADMINISTRATION?

Once you have a letter of administration, you will be responsible for taking care of the individual’s business affairs. This can include everything from filing taxes to issuing checks.

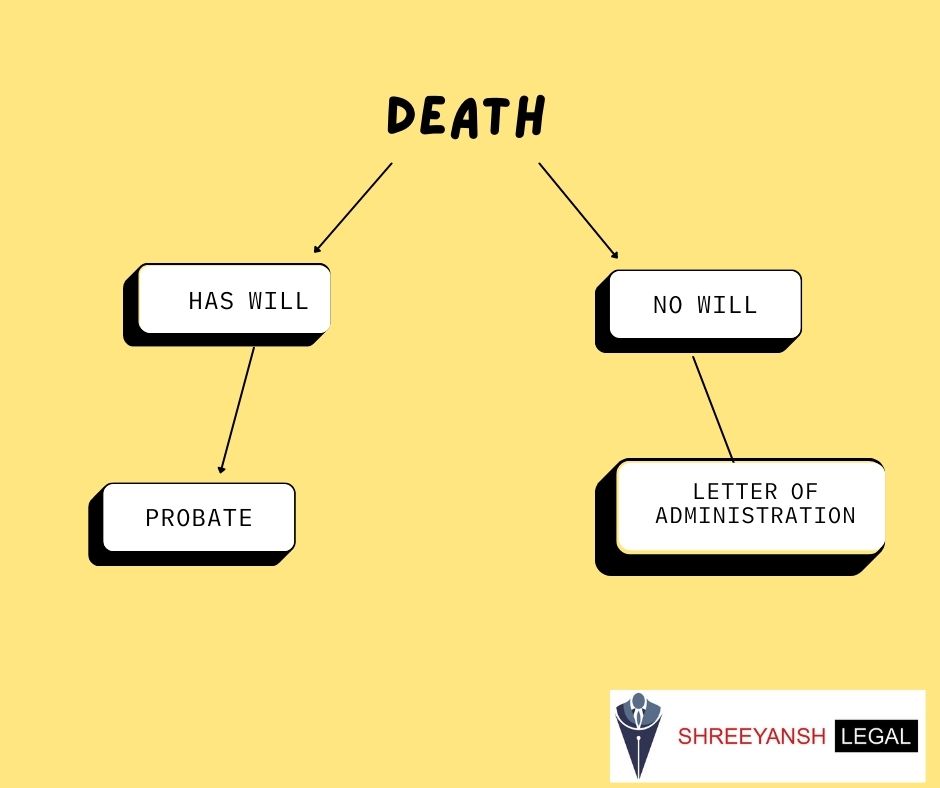

PROBATE AND LETTER OF ADMINISTRATION

Lets understand difference between letter of administration and probate

PROBATE

Probate is the process of transferring the ownership of property, including assets and liabilities, from one entity to another. The probate process is typically used when the deceased person has left a will and there are questions about who should inherit their property. In contrast, a letter of administration is a legal document that allows someone to manage an estate without having to go through probate. This can be helpful if the person who needs to administer the estate doesn’t have estate planning experience or if they are traveling or unable to travel.

Probate is the process of distributing an estate after a person dies. The court will appoint a probate judge to handle the probate process. The probate judge will send out letters to the people who are listed as heirs on the deceased person’s death certificate. The letters tell them that they have been appointed administrator of the estate and what steps they need to take to receive it. If there are any assets that are not There are a few things to keep in mind when using a letter of administration:

- You will need to provide proof of death or incapacity.

- You will need to file taxes and other estate-related paperwork.

- You will need to issue checks and make other financial decisions on behalf of the deceased person.

- You should contact the bank that the deceased person had accounts with in order to freeze their accounts and prevent them from being transferred out of the country without your permission.

TO WHOM PROBATE CANT BE GRANTED.

A probate judge cannot grant probate to a person who is deceased if they were married when they died. This is due to the fact that a married person can make a will. If the person was not married when they died, then their spouse can get probate.

TO WHOM PROBATE CANNOT BE GRANTED.

Probate can’t be granted to any of the following people:

- The person who died.

- Anyone who is not an heir listed on the death certificate.

- Anyone who has been convicted of a crime involving fraud or embezzlement in the past five years.

- anyone who is not a U.S. citizen or permanent resident.

The critical difference between letter of administration and probate is that Probate is granted to an executor nominated under the will, while Letter of Administration is granted to beneficiaries if a will does not nominate an executor.

When a person dies intestate or doesn’t nominate an executor under their will, the Letter of Administration grants authority to the beneficiaries to act on behalf of the deceased as if it had been granted at the time of death.

PROBATE AND SUCCCESSION CERTIFICATE

LETTER OF ADMINISTRATION

A letter of administration, also known as a Letters of Administration, is a document that confirms the death of a person and appoints someone to act as their personal representative in handling their estate. The document usually contains information about the deceased, such as their name, date of birth and death, identification information, and assets. It is also common to include instructions about how the estate should be managed and who should receive what property.

There are a few different ways to obtain a letter of administration. The most common way is for the person who is the deceased’s legal representative to apply for it. This person may be the spouse, civil partner, parent, child, or other relative who has been appointed as the personal representative by the court. In some cases, the personal representative may be someone who was not directly related to the deceased but was chosen by the court based on specific qualifications.

If you are not the legal representative of the deceased person, you can still get a letter of administration if you meet certain requirements. For example, you can apply if you are able to prove that you are financially capable of handling the estate and that you have been appointed by a court or other government body. You can also apply if you are acting on behalf of someone else who is entitled to receive a letter of administration in their name.

Once you have obtained a letter of administration, it is important to take care of all estate-related paperwork. This includes filing taxes and other documents with the appropriate government agencies, issuing checks and making other financial decisions on behalf of the deceased person, and freezing their bank accounts in order to prevent them from being transferred out of the country without your permission.

IS IT MANDATORY TO OBTAIN LETTER OF ADMINISTRATION?

A Letter of Administration is a legal document that is used to provide formal context to a deceased person’s estate. It is typically required in cases where there is no surviving spouse or child to act as the personal representative of the estate. The letter of administration must be filed with the appropriate government agency, such as the state probate court, and must be signed by at least one authorized person.

There is no one answer to this question since it depends on the specific circumstances of your case. In general, however, obtaining a letter of administration is often the first step in Estate Planning and can help streamline the process.

TO WHOM LETTER OF ADMINISTRATION CAN BE GRANTED.

A letter of administration, also known as a Letters of Administration Grant, is a legal document which allows the holder of an estate to administer the estate. The grantee usually is a personal representative or trustee appointed by the court. The grantee has full authority to manage and distribute the assets of the estate.

TO WHOM LETTER OF ADMINISTRATION CANNOT BE GRANTED.

A letter of administration cannot be granted to anyone who is not legally entitled to receive it. This includes the deceased person’s spouse, children, parents, grandparents, siblings and any other descendants of the deceased person who are under 21 years of age or over 65 years of age.

Lets understand about difference in letter of administration and succession certificate

LETTER OF ADMINISTRATION VS SUCCESSION CERTIFICATE

SUCCESSION CERTIFICATE

- If there is no Survivor amongst the account holders and no nomination had been done by the holder(s) earlier, a Succession Certificate will be the primary document through which heirs can stake a claim to assets of deceased relative.

- The executor of the estate will establish the authenticity of heirs and give them authority to inherit debts, securities, and other assets that the deceased may have left behind.

- The beneficiary has to go to the district or high court where the assets fall and file a petition for a succession certificate.

- After examining the petition, the court issues a notice to all those concerned. The notice also specifies a time frame (usually one-and-a-half months) within which anyone who has objections may raise them. If no one contests the notice and the court is satisfied, it passes an order to issue a succession certificate to the petitioner.

- If you have the certificate of authentication, then you are authenticated to distribute the assets to the legal heirs as per succession laws.

- A succession certificate is not issued in cases where probate of a will is necessary, such as when there is a valid will.

- In case of deceased was residing in Mumbai and the property claimed is in Mumbai then you have to apply for a letter of administration. If the property claimed is outside Mumbai then you have to apply for a succession certificate

GRANT OF LETTERS OF ADMINISTRATION WITH WILL ANNEXED

Grant of letters of administration with will annexed is a legal process which allows a person to administer their own estate, without the need for a lawyer. The process begins with filing an application with the probate court. Once approved, the court will issue letters of administration to the applicant. The letters will include instructions regarding who should receive assets and how they should be distributed. The will must be filed with the probate court along with the application for letters of administration.

APPLICATION FOR GRANT OF LETTERS OF ADMINISTRATION

Step 1: Complete and file an application for grant of letters of administration.

Step 2: Serve as a representative to accept the grant from the donor.

Step 3: Comply with all applicable state laws.

PROCESS FOR LETTERS OF ADMINISTRATION FROM COURT

- File the petition with the court

- Serve the petition on the personal representative or successor trustee

- File notice of hearing with the court

- Attend the hearing

- If a hearing is not held, file a summary judgment with the court

- Serve a copy of the summary judgment on the personal representative or successor trustee

The letters of administration are a legal document that allow a person to administer their own estate, without the need for a lawyer. The process begins with filing an application with the probate court. Once approved, the court will issue letters of administration to the applicant. The letters will include instructions regarding who should receive assets and how they should be distributed. The will must be filed with the probate court along with the application for letters of administration.

Here are some things to keep in mind when applying for letters of administration:

– Make sure you have all the required documents ready to submit when applying

– Serve notice of petition on all interested parties

– Hear arguments from interested parties

– Grant or deny administration

– Appoint personal representative

Grant of letters of administration generally occurs when a person has passed away and their estate is in need of someone to manage the affairs of the deceased. The letters typically provide authority to act on behalf of the deceased in all legal matters, including contracts, loans, and property transfers. It is important to note that letters of administration are not a substitute for a will. If there is any dispute about who should be granted Letters of Administration, the probate court will decide based on the evidence presented.

An application for letters of administration must be made to the probate court. Once approved, the court will issue letters of administration to the applicant. The letters will include instructions regarding who should receive assets and how they should be distributed. The will must be filed with the probate court along with the application for letters of administration.

grant of letters of administration without will

grant of letters of administration with no will annexed

CREDIT – CNBC-TV18

GRANT OF LETTERS OF ADMINISTRATION WITH WILL ANNEXED IN FOLLOWING SITUATIONS-

Testator has failed to appoint an executor under a Will OR

Where the executor appointed under a Will refuses to act OR

Where executor has died before or after proving the Will but before administration of the estate.

.

LETTERS OF ADMINISTRATION ACT

following act applicable for letters of administration granted with will annexed-

The Letters of Administration (Wills and Estates) Act, 1882

The Wills (Probate) Amendment Act, 1968

The Wills (Probate) Rules, 1976

PROBATE AND ADMINISTRATION ACT, 1977

The Indian Succession Act, 1925

APPLYING FOR LETTERS OF ADMINISTRATION WITHOUT WILL

If a person dies intestate, an administrator is appointed by the court through the issuance of Letters of Administration (LOA). The person who applies for LOA must state the reasons for wanting to apply. The court may appoint an administrator even if there is no will and even if there is a pending probate proceeding. If a person dies with a valid will, the court may issue letters of administration only if the will is annexed to the application. The court may refuse to issue letters of administration if it determines that the estate is insolvent or that distribution of assets would be inequitable.

If a person dies without a will, the court may distribute his or her assets according to state law . In these cases, the court usually appoints an administrator to manage the estate.

If the estate only includes movable assets, a succession certificate is filed with the court. If there are also immovable assets in the estate, then letters of administration must be obtained from the court to administer it. Even operating a deceased’s lockers with banks requires Letters of Administration from the court.

The process for applying for letters of administration varies depending on where you live. To find out more about applying for letters of administration in Mumbai, Thane, Navi Mumbai, Contact us.

If the estate only includes movable assets, a succession certificate is filed with the court. If there are also immovable assets in the estate, then letters of administration must be obtained from the court to administer it. Even operating a deceased’s lockers with banks requires Letters of Administration from the court.

APPLY FOR LETTERS OF ADMINISTRATION ONLINE

without s a document that is typically issued when a person has died and their estate needs to be managed. The granting of letters of administration typically occurs in the court system, and it gives the appointed administrator the authority to manage all aspects of the estate, including making decisions about what property should be sold, who should get money from the estate, and how debts should be paid. Letters of administration cannot often be obtained online .

LETTER OF ADMINISTRATION AFTER DEATH

If a person dies without a will, their property will be divided among their heirs according to the laws of intestacy. If there is no heir, the property will go to the state. If there is an heir, they will receive a letter of administration from the court to deal with the deceased’s property. This letter gives them authority to manage and sell the assets until their own death or until someone else takes over management.

LETTER OF ADMINISTRATION FOR BANK LOCKER

A letter of administration is a document that is used to provide formal context for the transfer of assets or management of a business. In the case of a bank locker, it would typically be used to indicate that someone has died and their property has been transferred to their family or designated representative. This letter will allow the bank to release the locker and protect the rights of the inheritors. letter of administration for bank locker is compulsory in case of some banks. Some banks to help legal heirs, allow NOC from the legal heir and indemnity bond from the beneficiary and by that way they can avoid letter of administration for bank locker.

WHAT DOCUMENTS DO I NEED FOR A LETTER OF ADMINISTRATION

- Proof of death (such as a death certificate or burial records)

- Identification of the deceased (such as a driver’s license or passport)

- Copy of the will or trust instrument

- Tax returns for the past two years

- Proof of residence, such as a utility bill or rent receipt

- Bank account statement or letter from the bank stating that the deceased had an account and had not recently withdrawn any money

- Letter of authority from the personal representative or attorney in charge of the estate

- Power of attorney authorizing someone else to act on behalf of the deceased in this matter

- Certificate of title to any property transferred as part of the estate

References and more to read :

- PROBATE OF WILL – HOW TO OBTAIN – EASY 5 STEPS GUIDE

- GIFT DEED REGISTRATION

- NOMINEE IN THE SHARES OF A CO-OP SOCIETY IS NOT THE OWNER

- HOW TO REGISTER A WILL IN MUMBAI, NAVI MUMBAI AND THANE – 5 EASY STEPS

- LETTER OF ADMINISTRATION.

CONTACT US FOR AVAILING PROFESSIONAL SERVICE OF LETTER OF ADMINISTRATION LAWYER, LETTER OF ADMINISTRATION LAWYER IN MUMBAI, PROBATE LAWYER, LETTER OF ADMINISTRATION LAWYER IN THANE , LETTER OF ADMINISTRATION LAWYER IN NAVI MUMBAI.