WHAT IS LETTER OF ADMINISTRATION?

A letter of administration is a document that is used to appoint a personal representative to oversee the affairs of a deceased person. This document typically includes instructions on how to collect and pay debts, manage the property, and contact creditors.

A letter of administration is a legal document that is used to administer an estate. letter of administration for immovable property necessary. It is typically used when a person has died and there are no living relatives who can take care of the estate.

When a person dies without a will, their property is distributed according to the laws of intestacy. This means that any assets the deceased owned are passed on to their heirs automatically. The person who is appointed as executor or administrator of a deceased’s estate is responsible for ensuring that the property goes to the rightful beneficiaries.

An example of when someone might need an administrator letter would be if they died without a will and were not married or had no children. In this case, state law would determine who gets what from their estates.

LETTER OF ADMINISTRATION MEANING

Letters of administration are issued by the Competent Probate Court to appoint suitable persons to administrate the property of a deceased person. Letter of administration for deceased estates is granted to dispose of the asset of a person who has died without a Will or in respect of assets that does not cover in same.

LETTERS OF ADMINISTRATION DEFINITION

The letter of administration section is provided as 234[4] of the Indian Succession Act, if the executor doesn’t exist, refuse, or is not capable of acting or is untraceable, then the person who would have been entitled to administer the estate in case of the deceased dying intestate would be entitled to file Petition for the Letter of Administration.

LETTER OF ADMINISTRATION MEANING IN HINDI

(प्रशासन पत्र) एक आधिकारिक अदालती दस्तावेज है जो मृत व्यक्ति की सभी संपत्ति का प्रशासन करने के लिए व्यक्ति (जिसे यह दिया गया है) को अधिकार देने के उद्देश्य से जारी किया गया है।

LETTER OF ADMINISTRATION MEANING IN MARATHI

LOA (प्रशासनाचे पत्र) हे अधिकृत न्यायालय दस्तऐवज आहे जे मृत व्यक्तीच्या सर्व मालमत्तेचे व्यवस्थापन करण्यासाठी त्या व्यक्तीला (ज्याला ते दिले जाते) अधिकार देण्याच्या उद्देशाने जारी केले जाते.

SITUATIONS IN WHICH LOA IS GRANTED/ WHEN TO APPLY FOR LETTERS OF ADMINISTRATION:

When –

• No Executor has been appointed in WILL.

• Executor appointed is legally not capable.

• Executor appointed refuses to act.

• Executor died before probate of WILL.

• Executor died before the testator.

• WILL is proved/probate granted but executor died immediately after that.

In above situation letters of administration with will annexed may be granted by the competent court.

There are a few situations in which letters of administration may be granted. If the deceased person did not have any children or if they did not leave behind any heirs, then the state or country may appoint someone to act on their behalf. Additionally, if the deceased person’s spouse is alive but does not want to take on all of their responsibilities, then their spouse may be appointed as letters administrator. Finally, if there is a dispute over who should receive an estate after a person dies, a grant of letters of administration can help resolve that issue.

LETTER OF ADMINISTRATION WITHOUT WILL IN INDIA –

When a person dies without a will means the person dies intestate, and their property is distributed according to state law. In case of there is no WILL letter of administration without will is possible by filing a letter of administration Bombay high court. letter of administration without will is not possible where there is the fact that will is made but original not available. If the person had a will, their property would be distributed according to the terms of the will.

Often, when a person dies without a will, the court will grant of letters of administration to someone who is mentioned in the will as an heir. Letters of administration are legal documents that appoint someone as an administrator of an estate and the said person will administer the estate. The administrator is responsible for allocating assets and overseeing the day-to-day operations of the estate.

A letter of administration (LOA) is an administrative document that is used to administer the affairs of a deceased person or organization. When a person dies intestate, their property and assets are distributed according to the laws of their state. If there is no valid will, the court will appoint an administrator to manage and oversee the estate.

To be appointed as an administrator, you must meet certain qualifications, including being financially solvent and having knowledge of estate law. The administrator may be a relative or friend of the deceased, but they must be approved by the court. The LOA grantor’s powers are limited to those necessary to administer the estate and make decisions on behalf of the beneficiaries.

The purpose of LOA is twofold: first, it gives administrators authority to act on behalf of beneficiaries in order to protect their interests; and second, it establishes deadlines for taking action so that everyone has time to understand and comply with court orders. A LOA should not be confused with a power of attorney (POA), which gives someone else legal authority over your affairs.

APPLYING FOR LETTERS OF ADMINISTRATION INDIA/ LETTER OF ADMINISTRATION IN INDIAN LAW :

Section 213 of the Ontario Wills, Trusts and Probate Act states that every executor or legatee must obtain a Probate/Letter of Administration of estate from a court before attempting to execute the will. If they do not follow this law, they may not be able to assert their rights in a court concerning any estate mentioned in the will.

LETTERS OF ADMINISTRATION WITH WILL

A letter of administration is a legal document that is used to administer the estate of a deceased person. A will is not always necessary, but it can be helpful in ensuring that the estate is appropriately divided and administered according to the deceased person’s wishes. If a will is not made, the court will appoint an administrator to manage the estate. Letters of administration are valid for a limited time period and must be filed annually with the court.

If there is any dispute about how the estate should be administered, you can file a motion with the court to have the administrator removed. However, removal of the administrator is rarely necessary – most disputes about how an estate should be administered can be resolved through negotiations between the parties involved in the dispute. When we opt for letter of administration with will, we have to compulsory file the original WILL along with all supporting documents, Petition for letter of administration with will be necessary for smooth process.

APPLYING FOR LETTERS OF ADMINISTRATION AFTER DEATH

A letter of administration of estate is a document that is used to administer an estate after the death of a person. The document typically includes a list of all the assets and liabilities of the deceased, as well as instructions for how to distribute those assets. If the WILL is available you can apply for grant of letters of administration with will annexed. Application for letters of administration depends on several factors after death like WILL is available or not and where the person died. You have to contact letter of administration lawyer for application for letters of administration.

LETTER OF ADMINISTRATION IN INDIAN LAW

Section 278 in The Indian Succession Act, 1925

278. Petition for letters of administration.—

(1) Application for letters of administration of estate shall be made by petition distinctly written as aforesaid and stating—

(a) the time and place of the deceased’s death;

(b) the family or other relatives of the deceased, and their respective residences;

(c) the right in which the petitioner claims;

(d) the amount of assets which are likely to come to the petitioner’s hands;

(e) when the application is to the District Judge, that the deceased at the time of his death had a fixed place of abode, or had some property, situate within the jurisdiction of the Judge; and

(f) when the application is to a District Delegate, that the deceased at the time of his death had a fixed place of abode within the jurisdiction of such Delegate.

(2) Where the application is to the District Judge and any portion of the assets likely to come to the petitioner’s hands is situate in another State, the petition shall further state the amount of such assets in each State and the District Judges within whose jurisdiction such assets are situated.

PERSONS WHO CAN BE APPOINTED AS THE ADMINISTRATOR :

letter of administration under Indian succession act section 218 may be granted to any person who, according to the rules for the distribution of the estate applicable in the case of such deceased, would be entitled to the whole or any part of such deceased persons property.

When many of such persons make application for letter of administration for deceased estates, it shall be the decision of the Court to grant it to any one or more of them. When no person applies for letter of administration for deceased estates, letter of administration of estate may be granted to a creditor of the deceased.

If the deceased is a Hindu, Muhammadan, Buddhist, Sikh or Jains or an exempted person, a grant of letters of administration of his estate may be given by the court to any qualified applicant according to applicable rules for the distribution of estates;

If no qualified applicant applies, then administration may be granted to those who are connected either by marriage or consanguinity in this order- widow to be appointed in case of death of husband provided that she should not be entitled to it on the ground of lunacy, adultery or because she has no interest, husband to be appointed as administrator in case of death of wife. In Mumbai, any of the relatives or beneficiaries could be executors provided the consent of the other legal heirs.

WHERE TO APPLY FOR GRANT OF LETTERS OF ADMINISTRATION :

1: District Court in whose jurisdiction the property is situated.

2: Court in whose jurisdiction the deceased last resided.

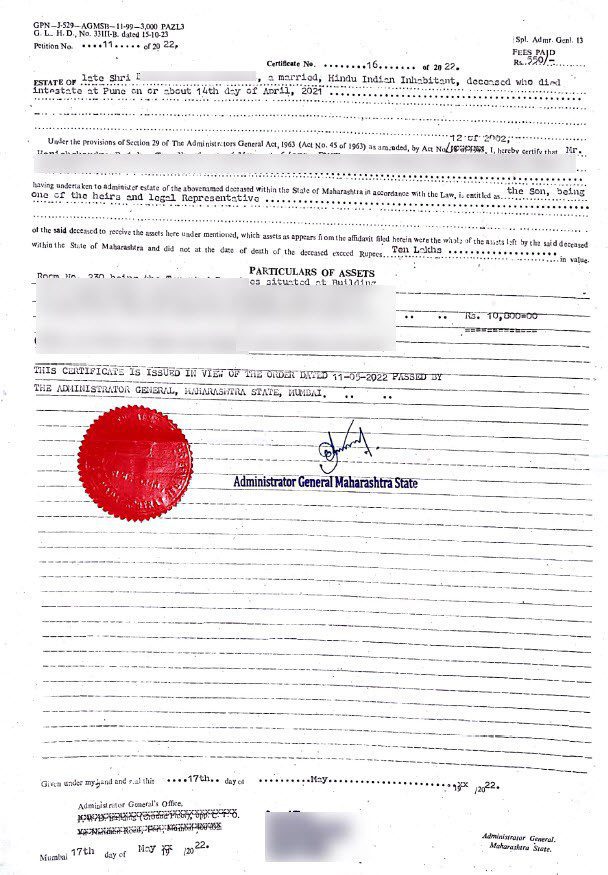

LETTER OF ADMINISTRATION IN MUMBAI

Application for letters of administration in mumbai is possible in case of Property is in Mumbai jurisdiction and the said property is having a value less than 10 lacs and Letter of administration is required to be applied Before The Administrator General, Maharashtra State, Mumbai.

In case of Property is in Mumbai jurisdiction and the said property is having more than 10 lacs then a Letter of administration is required to be applied within the local limits of the ordinary original civil jurisdiction of the High Courts of Judicature, Mumbai.

letter of administration in mumbai and out of Mumbai it is done in form of Succession certificate. If the property is in Mumbai you have to get letter of administration in mumbai and if out of Mumbai then Succession certifcate.

LETTER OF ADMINISTRATION BOMBAY HIGH COURT-

If the property is in Mumbai/the deceased died in Mumbai you need to file letter of administration from high court, Fort, Mumbai, Maharashtra 40000

DOCUMENTS NEEDED FOR LETTER OF ADMINISTRATION :

Following documents are required while applying for letters of administration.

1. Original Death Certificate of deceased and PAN and AADHAR if available. It’s advisable to keep a certified copy of the original death certificate at the time of filing in the court

2. PAN and AADHAR of all the descendants.

3. Passport size Photos of all the descendants.

4. Ration card copy of the deceased.

5. Original WILL (In case available)

There will be more documents required for letter of administration in certain situations. If there are shares only left by the deceased then there will be additional documents required for letter of administration i.e share certificate having folio number. Obtaining letters of administration will be a difficult task if the above documents are not available. For obtaining letters of administration you need to pay court fees while filing petition but if you do not give documents which are required for valuation of your property, filing could not be done.

FOLLOWING ARE THE ANSWERS FOR THE QUESTIONS -HOW DO YOU GET A LETTER OF ADMINISTRATION FOR IMMOVABLE PROPERTY FROM THE COURT???

PROCEDURE FOR LETTER OF ADMINISTRATION :

1. Compilation of the above documents.

2. Drafting of Petition for letter of administration for immovable property.

3. Filing of the Petition.

4. Removing objections if any.

5. Hearing before court.

6. Judgement.

HOW TO APPLY FOR A LETTER OF ADMINISTRATION?

The process of applying for letters of administration can be a little daunting, but it is important to remember that there are strict guidelines that must be followed in order to protect the estate and the beneficiaries. Here are some tips on how to go about getting a letter of administration :

1. Make a list of all the assets and liabilities of the deceased person. This will help you determine which documents need to be filed with the court.

2. Contact a letter of administration lawyer and seek independent legal advice, who specializes in estate litigation or probate law to get advice on filing paperwork correctly. They can also provide guidance on what is letter of administration and what steps should be taken if there is any disagreement among those handling the estate.

3. Complete and file all required letter of administration form with the court clerk at least three weeks before you want your letter of administration to become effective. This will allow other parties involved in the estate to have enough time to respond properly.

4. Plan ahead and make arrangements for whoever will be responsible for adm5inistering the estate once you receive your letter of administration. This person may need access to all financial records, legal documents, and personal belongings related to the deceased person. It is important that they are aware of their responsibilities and able to carry them out effectively.

LETTER OF ADMINISTRATION FORMAT INDIA/ SAMPLE LETTERS OF ADMINISTRATION

Call us and get a letter of administration format pdf.

LETTER OF ADMINISTRATION FORMAT/SAMPLE LETTERS OF ADMINISTRATION WILL BE DIFFERENT DEPENDING UPON THE COURTS WHERE THE PETITION FOR LETTER OF ADMINISTRATION IS FILED.

Step 1: Write the person’s full name

Step 2: List the date of death

Step 3: List the cause of death

Step 4: List the place of death

Step 5: List the name of the person’s next of kin

CAN LETTER OF ADMINISTRATION BE CHALLENGED? CHALLENGING LETTERS OF ADMINISTRATION?

There is no set time limit for challenging letters of administration, but it is generally easier to do so if there are any outstanding legal issues relating to the estate. In some cases, the executor or trustee may be required to take specific steps (such as selling assets) without the consent of the beneficiaries of the deceased’s will. If this happens, you may have grounds for challenging letters of administration and the executor’s actions in court.

If you are appointed executor of someone’s estate, it is important to understand your responsibilities and the letter of administration process involved. If you have any questions about your role or the administration of the estate, please do not hesitate to contact an attorney to seek independent legal advice. There are a few things you can do if you believe that the executor has done something wrong:

First, if there is money in the estate that you think should be going to someone other than the executor, you may want to consider challenging letters of administration. Check with your state bar association or legal counsel for more information on how to go about this.

Second, if there are personal items in the estate that are related to the deceased person, such as photographs or jewelry, make sure they are distributed according to their wishes. This can be difficult if there is disagreement among those closest to the deceased person about what should be done with these possessions. Again, contacting an attorney may help resolve any disputes quickly and legally before contesting letters of administration.

If you believe that a letter of administration is not properly or lawfully issued, you can file a petition for challenging letters of administration. If you are contesting letters of administration you require evidence that the decedent did not die voluntarily or by accident, and that there are no heirs available to take over the estate. If successful, you may be able to annul the letter and appoint another person as administrator. So before contesting letters of administration you have to consider the above aspect.

HOW TO APPLY FOR A LETTER OF ADMINISTRATION

The process of applying for a letter of administration can be a little daunting, but it is important to remember that there are strict guidelines that must be followed in order to protect the estate and the beneficiaries. Here are some tips on how to go about getting a letter of administration :

1. Make a list of all the assets and liabilities of the deceased person. This will help you determine which documents need to be filed with the court.

2. Contact an attorney who specializes in estate litigation or probate law to get advice on filing paperwork correctly. They can also provide guidance on what steps should be taken if there is any disagreement among those handling the estate.

3. Complete and file all required letter of administration form with the court clerk at least three weeks before you want your letter of administration of estate to become effective. This will allow other parties involved in the estate to have enough time to respond properly.

4. Plan ahead and make arrangements for whoever will be responsible for administering the estate once you receive your letter of administration for immovable property. This person may need access to all financial records, legal documents, and personal belongings related to the deceased person. It is important that they are aware of their responsibilities and able to carry them out effectively.

FEE FOR LETTER OF ADMINISTRATION FOR IMMOVABLE PROPERTY AND LETTER OF ADMINISTRATION COURT FEES-

If you are applying for letters of administration, letters of administration cost is generally determined by the amount of work required to complete the letter of administration process. how much does it cost to get a letter of administration can depend on the size and complexity of the estate, as well as the jurisdiction in which it is filed. In some cases, a letter of administration lawyer may be appointed to carry out the administrative tasks for you, while in others you may be able to do them yourself. There are also online resources that can make completing an LOA easier. Before you apply you have to calculate cost of obtaining letters of administration on the basis of the abovesaid criteria.

LETTER OF ADMINISTRATION COURT FEES –

The cost of obtaining letters of administration depends on the following factors-

letter of administration court fees wil be 5% of the total market value of the estate you are claiming or maximum – Rs. 75,000/-. There is the capping of Rs. 75,000/- . In any situation if the property you are claiming under LOA is having value more than 5 caror, you have to pay only maximum court fee for letters of administration i.e. Rs. 75,000/- not 5% of the 5 carors. Please note that letter of administration for immovable property court fees will be different as per respective state laws.

HOW LONG DOES IT TAKE TO GET A LETTER OF ADMINISTRATION OF ESTATE-

Generally, it takes 6 to 8 months to get a letter of administration. In case of objections raised in respect of documents produced for LOA, it may take more than 6 months.

letter of administration is always necessary before the estate can be distributed. Probate is the legal process of determining whether a person has died with a will and, if so, what should happen to their property. Letters of administration are court orders that give someone (usually a personal representative) authority to manage an estate until the probate process is complete.

LETTER OF ADMINISTRATION BANK ACCOUNT

If you want to administer an estate with a bank account, you will need to file a petition with the court. The petition will require proof of the decedent’s death, identification of the heir or heirs, and information about the bank account. Once you have filed the petition, the court will appoint an administrator to manage the bank account until the heir or heirs can take over.

When attempting to inherit money from a financial institution, such as a bank, mutual fund AMC, or demat account, the institution may request documentation verifying your right to inherit the money. Such documents might include a succession certificate or letter of administration or probated copy of the will. Once you have provided these documents, the institution will initiate transfer of funds from your relative’s account to yours.

After completing above process you may file certified copy of letters of administration in the office of concerned bank to manage accounts. Copy of letter of administration is required to be filed in process of administering the estate of the deceased.

Credit – Jims Greater Noida Online education

NOTIFICATION

On receipt the Application for letters of administration, the court issues notice to the legal heirs of the deceased to file objections, if any, to grant of letters of administration. In such case if the any of the legal heir having objection can file his/her objection with help of lawyers for will disputes. Attorney file his objection in court on WILL of the application is filed for Grant of letters of administration with will annexed and if the court satisfies then it will be converted into Suit.

VALUATION OF PROPERTY FOR LOA PURPOSES

Valuation of property for probate purposes depends on the nature of the property claimed suppose if it is movable property like shares of company then you have to get value of the share of the date on which application going to be filed. If the property is immovable like flat or land then you have to get market rate of the property as per current government valuation. For filing petition for probate of WILL, you can appoint official professional valuer or Probate lawyer could also do the same by taking of government Website portal like igrmaharashtra.

References and more to read :

- PROBATE OF WILL – HOW TO OBTAIN – EASY 5 STEPS GUIDE

- GIFT DEED REGISTRATION

- NOMINEE IN THE SHARES OF A CO-OP SOCIETY IS NOT THE OWNER

- HOW TO REGISTER A WILL IN MUMBAI, NAVI MUMBAI AND THANE – 5 EASY STEPS

- PROBATE LETTER OF ADMINISTRATION AND SUCCESSION CERTIFICATE.

CONTACT US FOR AVAILING PROFESSIONAL SERVICE OF LETTER OF ADMINISTRATION LAWYER, LETTER OF ADMINISTRATION LAWYER IN MUMBAI, PROBATE LAWYER, LETTER OF ADMINISTRATION LAWYER IN THANE , LETTER OF ADMINISTRATION LAWYER IN NAVI MUMBAI.